net investment income tax 2021 trusts

So for example if a trust earns 10000 in income during. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

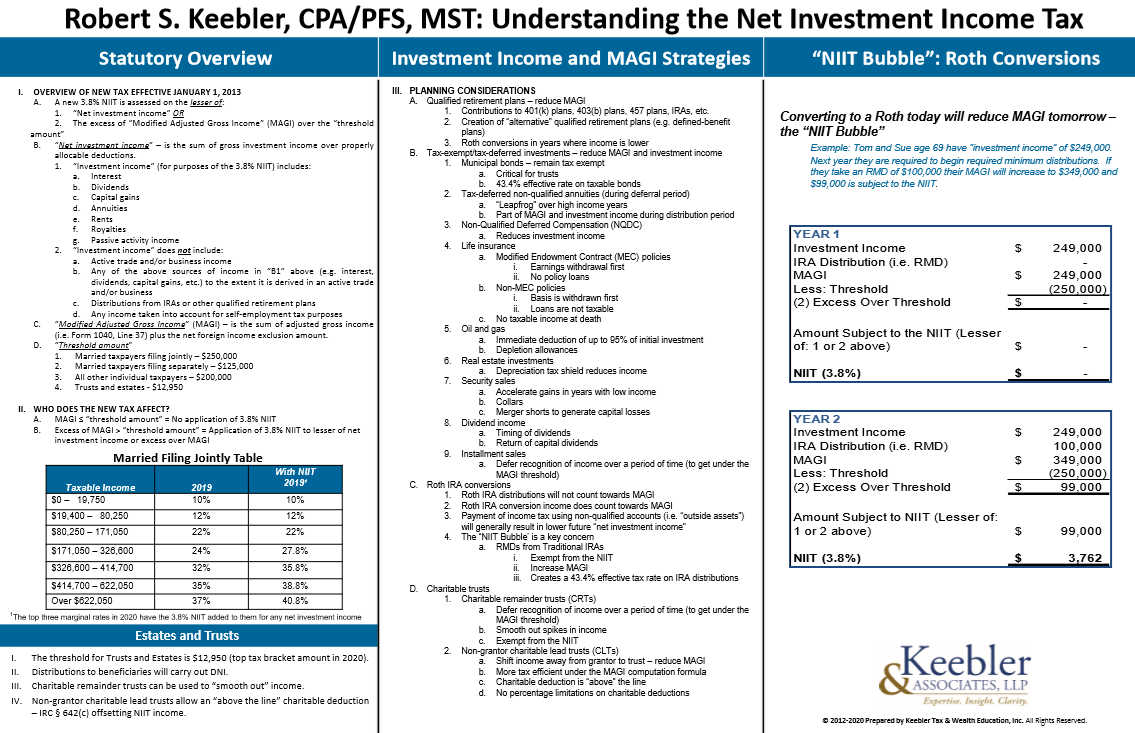

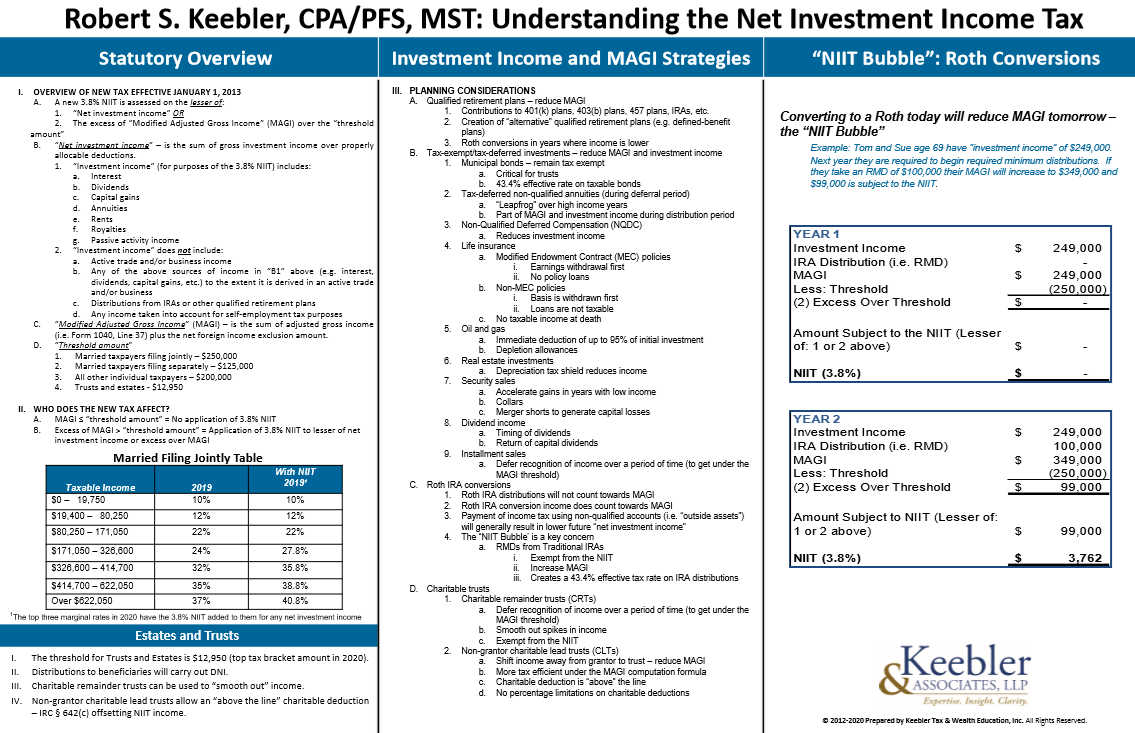

Client Friendly Charts Handouts Archives Ultimate Estate Planner

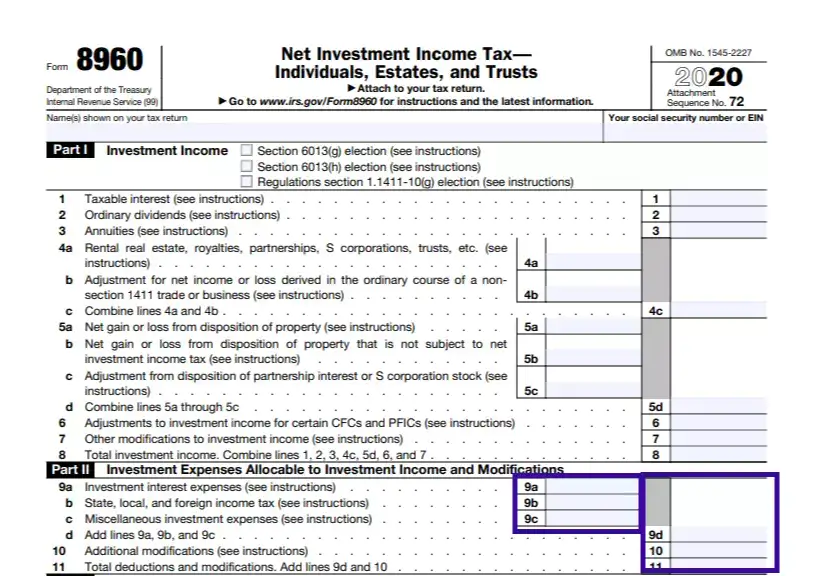

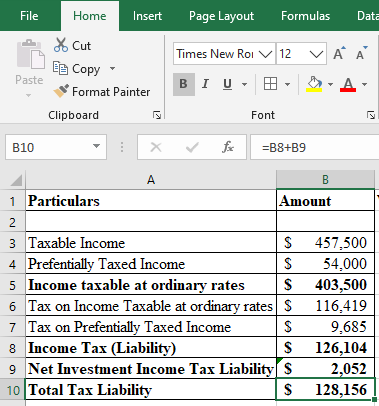

This is the detailed computation of the Net Investment Income Tax which is regulated by section 1411 of the Internal Revenue Code.

. The standard rules apply to these four tax brackets. Section 1411 imposes a non-deductible 38 tax on. All About the Net Investment Income Tax.

The standard rules apply to these four tax brackets. 2022-01-07 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of. Share on Twitter.

Generally net investment income includes gross income from interest dividends annuities and royalties. These tax levels also apply to all income generated by estates. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

Effective January 1 2013 Code Sec. When the Patient Protection and Affordable Care Act healthcare reform was passed in 2010 it included a tax increase that went into effect for this. Net investment income NII is income received from investment assets before taxes such as bonds stocks mutual funds loans and other investments less related.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. The NIIT is 38 percent on certain net investment income. They would apply to the tax return filed in.

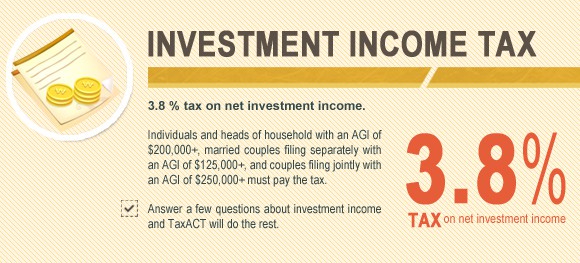

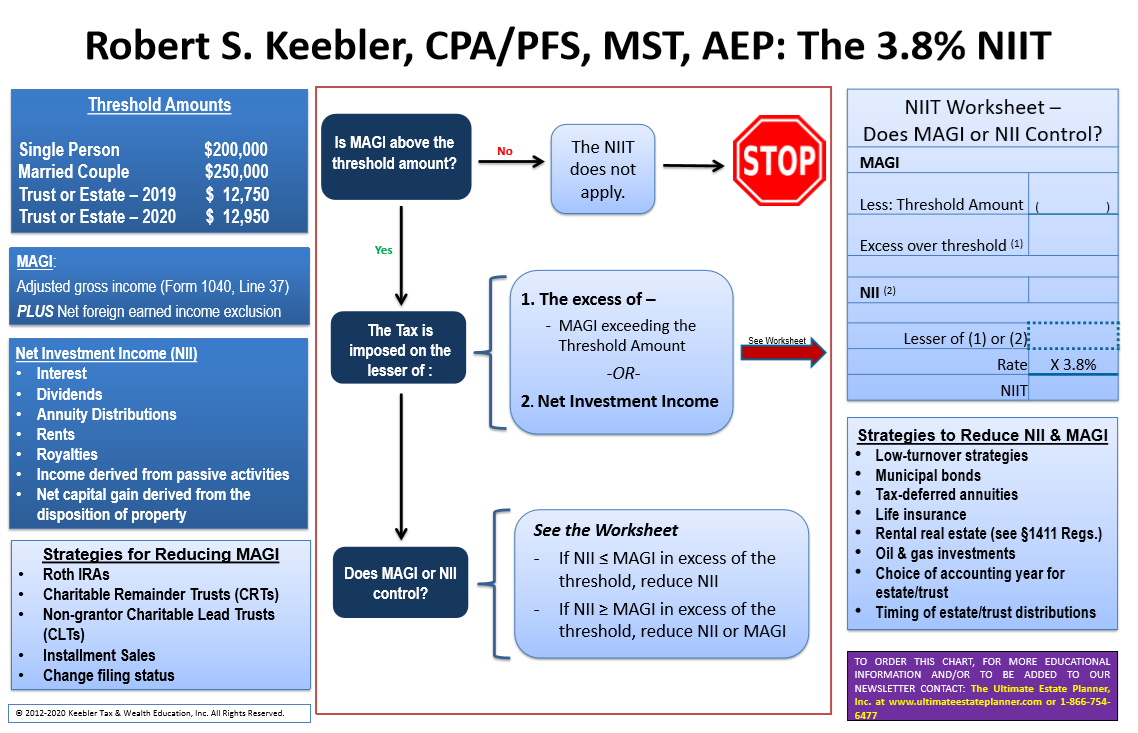

1411 imposes the 38-percent Net Investment Income Tax NIIT on the net investment income of individuals trusts and estates. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

The estates or trusts portion of net investment income tax is calculated on Form. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. So for example if a trust earns 10000 in income during.

We earlier published easy. Its just 38 which means you take your earnings and multiply them by 0038. Trust pays tax on the lesser of.

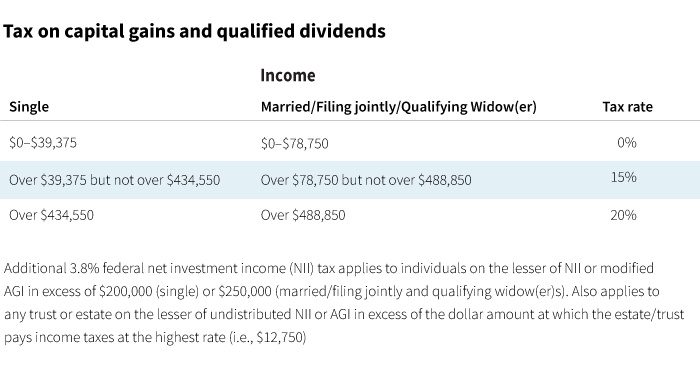

More precisely the NIIT is the lesser of 1 net investment income or 2 the amount by which Modified Adjusted Gross Income. 2021 Form 8960 Author. Thus the total amount.

The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year. April 28 2021 The 38 Net Investment Income Tax. The Heath Care and Education Reconciliation Act of 2010 added Section 1411 to the Code effective December 31 2012.

Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. However what you apply the 38 to depends. 1 It applies to individuals families estates and trusts.

These tax levels also apply to all income generated by estates. Net Investment Income Tax Individuals Estates and Trusts Keywords. Here the 5000 of capital gain excluded from DNI clearly net investment income is added to the 22500 of net investment income retained by the trust.

Taxpayers use this form to figure the amount of their net investment income tax NIIT. B The excess of AGI 38000 calculated in Step 2 B. A The combined undistributed net investment income 41000 calculated in Step 1 C.

Your net investment income aka the.

Irs Form 8960 Fill Out Printable Pdf Forms Online

Net Investment Income Tax Niit Quick Guides Asena Advisors

How To Calculate The Net Investment Income Properly

What Is The 3 8 Medicare Tax Or Net Investment Income Tax Niit Legal 1031

Answered Required Information The Following Bartleby

How To Calculate The Net Investment Income Properly

What Is The The Net Investment Income Tax Niit Forbes Advisor

What Is Net Investment Income Tax Overview Of The 3 8 Tax

How To Complete Irs Form 8960 Net Investment Income Tax Of 3 8 Youtube

How To Calculate The Net Investment Income Properly

What Is The Net Investment Income Tax Caras Shulman

Affordable Care Act Tax Law Changes For Higher Income Taxpayers Taxact Blog

After The Aca Tax Planning For The Current Net Investment Income Tax Cpa Practice Advisor

Gauge Your Tax Bracket To Drive Tax Planning At Year End

What Is The 3 8 Net Investment Income Tax Niit Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef